Equity Loan Options: Picking the Right One for You

Equity Loan Options: Picking the Right One for You

Blog Article

Optimize Your Assets With a Strategic Home Equity Car Loan Strategy

In the world of monetary management, one usually looks for avenues to optimize assets and make tactical decisions that produce long-lasting advantages. One such opportunity that has actually gathered interest is the use of home equity via an attentively crafted funding plan. By using the equity developed within your home, a variety of possibilities emerge, using a prospective boost to your economic portfolio. However, the key exists not just in accessing these funds but in developing a strategic strategy that maximizes their potential. As we browse the complex landscape of home equity car loans, the importance of cautious planning and insight ends up being increasingly obvious.

Understanding Home Equity Financings

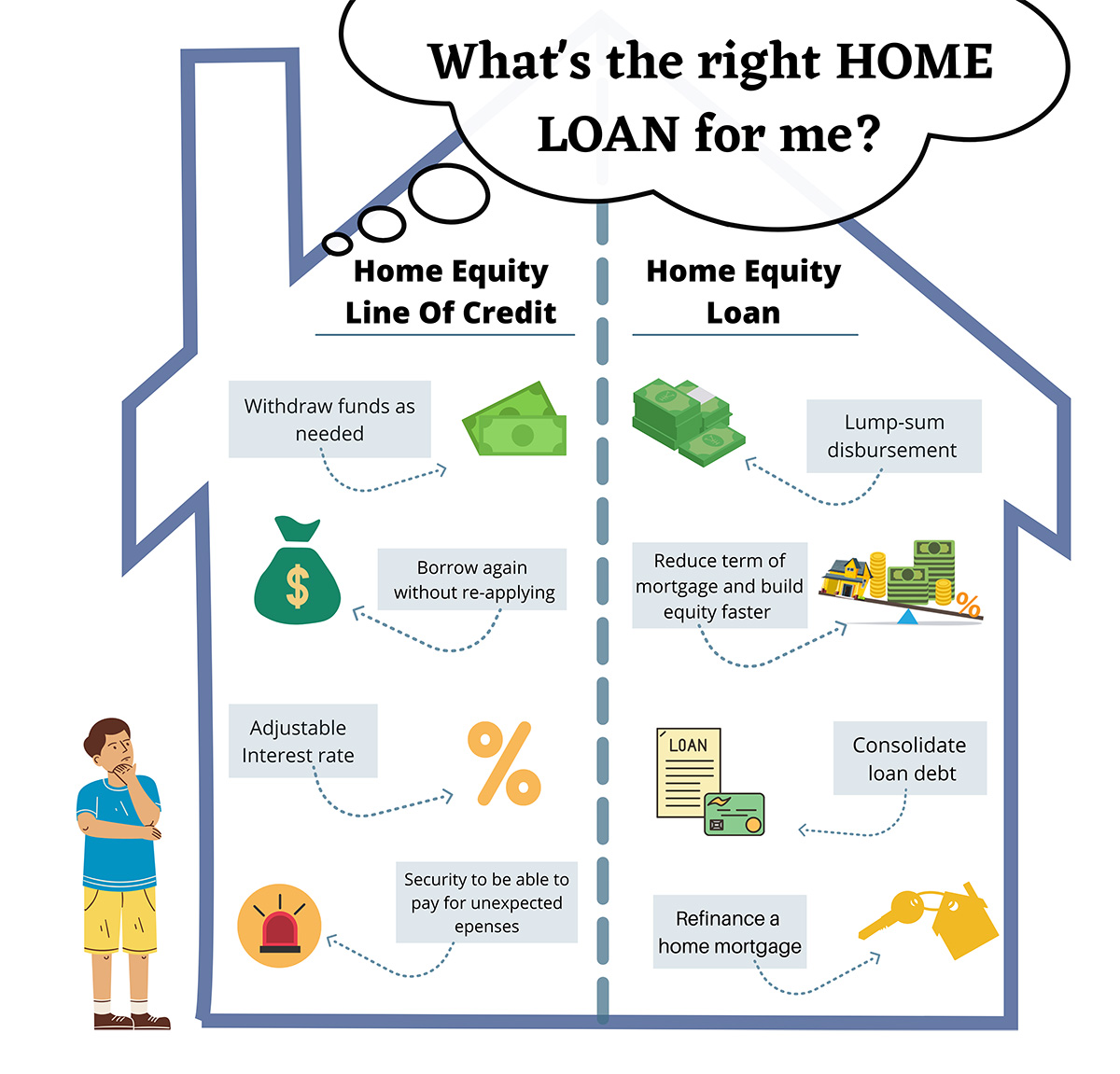

A detailed grasp of the ins and outs surrounding home equity financings is essential for informed monetary decision-making. Home equity lendings permit property owners to utilize the equity developed up in their residential or commercial property to accessibility funds for various objectives. One key element to understand is that these fundings are protected by the value of the home itself, making them much less risky for lenders and commonly resulting in lower rates of interest for customers compared to unsafe financings.

Moreover, recognizing the loan-to-value ratio, repayment terms, prospective tax obligation ramifications, and the dangers associated with using your home as security are crucial elements of making audio economic decisions regarding home equity car loans. By acquiring an extensive understanding of these elements, property owners can utilize home equity lendings tactically to accomplish their monetary objectives.

Advantages of Leveraging Home Equity

Making use of the equity in your house can provide a variety of financial advantages when strategically leveraged. Among the main benefits of leveraging home equity is access to large amounts of cash at relatively low passion prices compared to other types of borrowing. By utilizing your home as security, lenders are much more prepared to use desirable terms, making home equity lendings an appealing choice for funding significant expenditures such as home improvements, education and learning costs, or debt consolidation

In addition, the interest paid on home equity lendings is typically tax-deductible, supplying prospective cost savings for house owners. This tax obligation benefit can make leveraging home equity much more cost-effective contrasted to various other sorts of finances. In addition, home equity car loans typically offer longer repayment terms than individual financings or credit history cards, enabling more manageable month-to-month settlements.

Additionally, by reinvesting borrowed funds into home improvements, home owners can possibly enhance the value of their property. This can cause a greater resale value or improved living problems, even more enhancing the economic benefits of leveraging home equity. Overall, leveraging home equity intelligently can be a critical monetary move with numerous advantages for homeowners.

Strategic Preparation for Car Loan Utilization

Having actually established the advantages of leveraging home equity, the next crucial action is strategically preparing for the usage of the lending profits - Equity Loans. When considering exactly how to best utilize the funds from a home equity lending, it is crucial to have a clear plan in area to optimize the benefits and make sure economic stability

One calculated approach is to utilize the lending earnings for home renovations that will boost the residential or commercial property's go to this web-site worth. Improvements such as kitchen upgrades, shower room remodels, or including additional home can not just improve your everyday living experience however also increase the resale value of your home.

Another sensible use home equity finance funds is to consolidate high-interest financial obligation. By settling bank card, personal finances, or other debts with lower rates of interest profits from a home equity loan, you can save money on rate of interest repayments and streamline your funds.

Last but not least, investing in education or moneying a significant cost like a wedding event or medical costs can likewise be strategic usages of home equity finance funds. By thoroughly planning just how to assign the profits, you can utilize your home equity to attain your economic objectives successfully.

Factors To Consider and dangers to Bear in mind

When considering the application of a home equity funding,Considering the prospective pitfalls and elements to take into account is essential. Among the key dangers associated with a home equity lending is the possibility of failing on repayments. Considering that the car loan is safeguarded by your home, failure to pay off can result in the loss of your building through foreclosure. It's necessary to assess your monetary security and ensure that you can pleasantly handle the additional financial debt.

Another consideration is the fluctuating nature of rate of interest (Home Equity Loan) (Alpine Credits). Home equity financings commonly include variable rates of interest, suggesting your regular monthly payments can enhance if rate of interest rise. This possible boost should be factored right into your economic planning to stay clear of any kind of surprises down the line

Additionally, beware of overborrowing. While it may be appealing to access a large amount of money with a home equity car loan, only borrow what you absolutely require and can afford to pay off. Mindful consideration and prudent monetary management are vital to efficiently leveraging a home equity loan without dropping into economic difficulties.

Tips for Effective Home Equity Lending Management

When navigating the world of home equity car loans, prudent monetary administration is necessary for enhancing the benefits and minimizing the associated dangers. To successfully manage a home equity loan, beginning by creating a comprehensive spending plan that details your month-to-month revenue, expenditures, and lending repayment responsibilities. It is important to prioritize timely payments to avoid fines and preserve a good credit report.

On a regular basis monitoring your home's worth and the equity you have constructed can assist you make notified decisions about leveraging your equity better or changing your settlement technique - Home Equity Loans. Furthermore, consider establishing up automated repayments to make certain that you never miss out on a due day, therefore guarding your financial standing

One more pointer for successful home equity financing administration is to discover opportunities for re-financing if rate of interest drop significantly or if your credit report improves. Refinancing might possibly lower your regular monthly repayments or permit you to pay off the funding much faster, conserving you money in the future. By complying with these approaches and remaining proactive in your financial planning, you can effectively handle your home equity loan and make the most of this important monetary device.

Conclusion

To conclude, tactical preparation is necessary when utilizing a home equity financing to take full advantage of possessions. Comprehending the dangers and benefits, as well as thoroughly considering how the funds will be used, can aid make certain effective monitoring of the finance. By leveraging home equity intelligently, people can take advantage of their assets and attain their financial goals.

Home equity financings allow house owners to utilize the equity built up in their residential property to accessibility funds for various functions. By utilizing your home as security, loan providers are much more willing to offer desirable terms, making home equity finances an appealing option for funding significant expenses such as home improvements, education and learning costs, or financial debt combination.

Additionally, home equity financings normally provide much longer payment terms than personal financings or credit score cards, enabling for even more workable month-to-month repayments.

Mindful consideration and sensible monetary monitoring are essential to efficiently leveraging a home equity funding without dropping into economic difficulties.

To successfully manage a home equity finance, start by producing a detailed budget plan that details your monthly earnings, expenses, and car loan repayment obligations.

Report this page